Investors Double Down on Rental Properties

The Trend of Investing in Rental Properties

As the real estate market continues to evolve, investors are finding success by doubling down on rental properties. This growing trend in the lifestyle industry provides individuals with lucrative opportunities to generate passive income and build long-term wealth.

The Benefits of Rental Property Investments

Investing in rental properties offers a range of benefits:

- Cash Flow: Rental properties provide a steady stream of income through monthly rental payments, ensuring a consistent cash flow for investors.

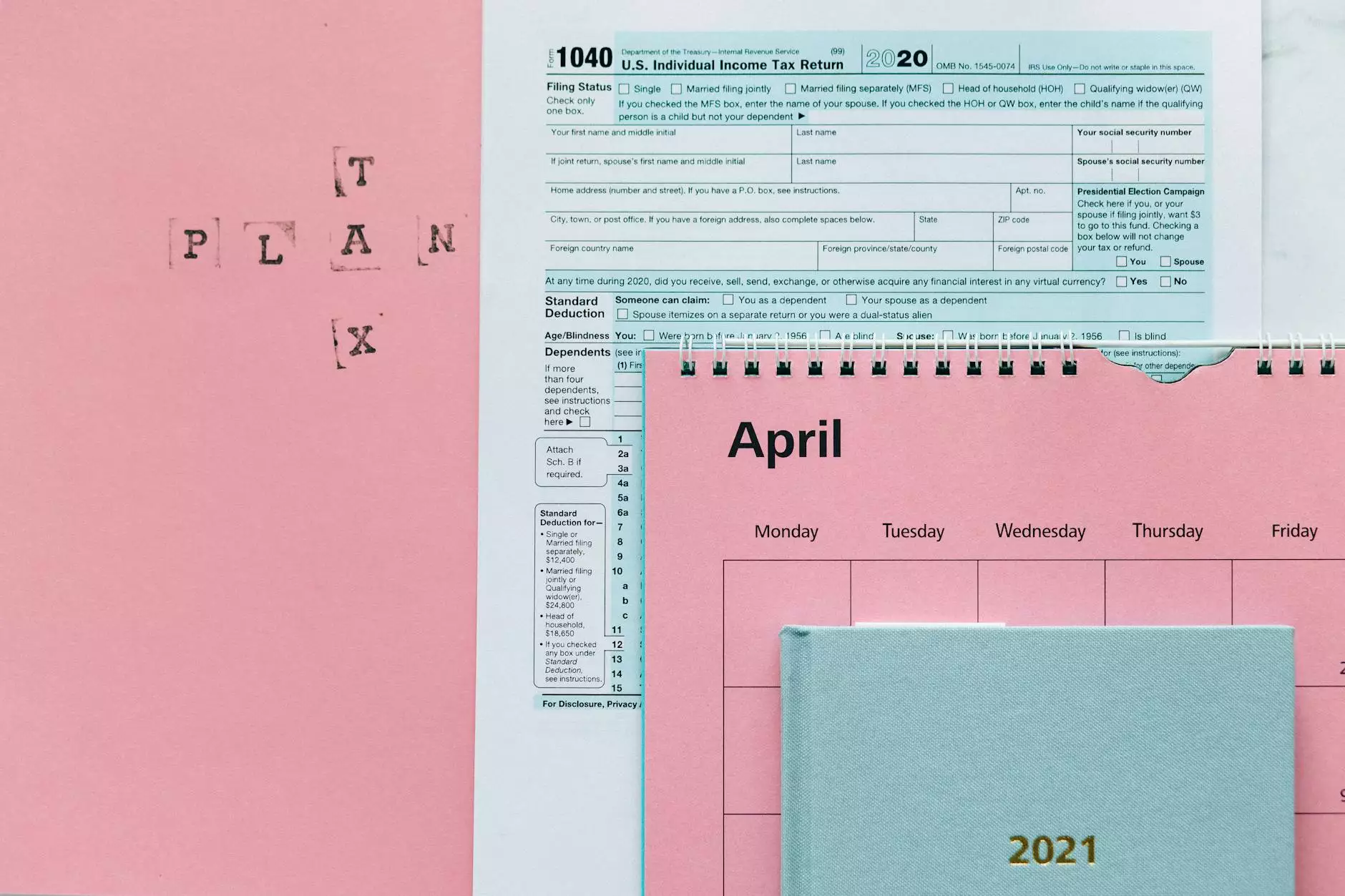

- Tax Advantages: Real estate investors can take advantage of various tax benefits such as deductions on mortgage interest, property taxes, and repairs.

- Long-Term Appreciation: Rental properties often appreciate in value over time, allowing investors to build equity and potentially realize substantial gains in the future.

- Diversification: Adding rental properties to a diversified investment portfolio can reduce risk by spreading wealth across different asset classes.

- Control: Investors have control over crucial factors such as rental rates, tenant selection, and property management, providing a sense of autonomy and flexibility.

Strategies for Successful Rental Property Investments

When it comes to investing in rental properties, it's important to consider various strategies to maximize returns:

Location, Location, Location

Choosing the right location is crucial for the success of a rental property investment. High-demand areas with amenities such as schools, shopping centers, and transportation hubs tend to attract quality tenants and yield higher rental rates.

Thorough Market Research

Conducting comprehensive market research helps identify emerging rental property markets, potential rent growth, and market stability. Understanding market trends and demographics can guide investors in making informed decisions.

Calculating Expenses and Returns

Accurately calculating expenses, including mortgage payments, property taxes, insurance, maintenance costs, and property management fees, is crucial to ensure positive cash flow and maximize returns on investment. Utilize financial tools and consult with professionals if needed.

Tenant Screening and Property Management

Developing solid tenant screening criteria and implementing effective property management strategies can help investors minimize vacancies, reduce maintenance costs, and ensure a positive rental experience for tenants, leading to long-term profitability.

Continuous Learning and Adaptation

The real estate market is dynamic, and staying updated with industry trends, regulations, and investment strategies is essential for investors to adapt and make informed decisions. Joining professional networks and attending workshops can provide valuable insights and opportunities.

The Future of Rental Property Investments

The future of rental property investments looks promising, with increasing demand for housing and a growing preference for rental options among individuals seeking flexibility. Real estate investors who adopt innovative approaches, leverage technology, and prioritize sustainability can stay ahead of the curve and capitalize on this evolving market.

Investors double down on rental properties because of the long-term financial benefits they offer. By investing wisely, performing thorough due diligence, and staying updated with market trends, individuals can achieve their financial goals and secure their financial future.